Are you still using spreadsheets to track your organizations assets?

Tracking assets is an important concern of every company, regardless of size. Organizations face a significant challenge to track numerous aspects of their fixed assets including location, quantity, condition, maintenance and depreciation status.

For many organizations, fixed assets represent the largest item on the balance sheet; in fact, a recent Aberdeen report showed that 80% of Fortune 500 firms listed fixed assets as such. With so much at stake, it's no wonder that Aberdeen found 58% of users run a fixed asset management solution. If the company has not correctly recorded their assets they could risk inaccurate physical inventories, over / underpaying taxes and insurance, be out of compliance of state and federal regulations, and be wasting staff time with redundant and repetitive activities as a result.

Spreadsheets: The Risk of Doing it Wrong

While we're thrilled to hear 58% of users run a fixed asset management solution that still means a concerning 42% are managing their business assets with spreadsheets👎 and while they are inherently useful in business, spreadsheets are decidedly not the best tool for managing fixed assets.

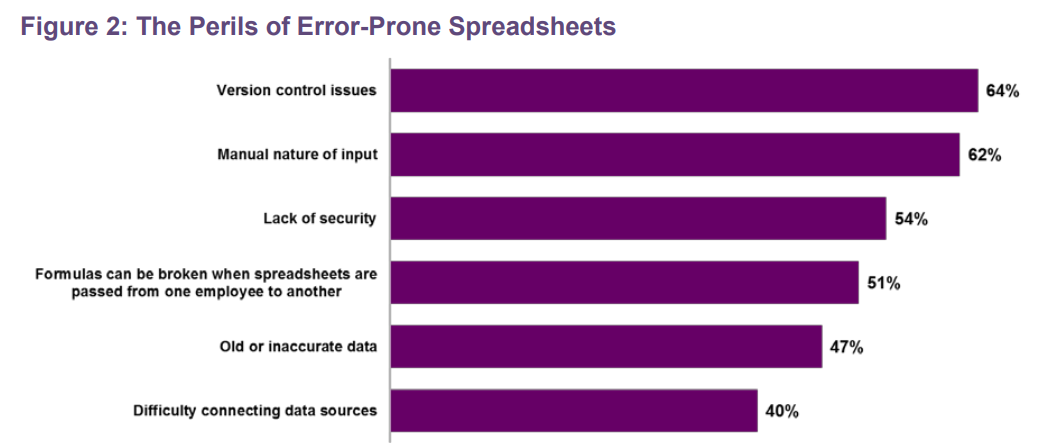

That's because the vast majority of current spreadsheet users are reporting common issues like version control, lack of security, broken formulas when the spreadsheet is passed form one employee to another, the list goes on!

Ready to learn how Sage Fixed Assets can help eliminate spreadsheet stress?

Join us for our virtual coffee chat Thursday, September 24th! We'll be discussing the key differences between utilizing spreadsheets vs. software and the benefits you can't afford to miss out on, listed below!

Plus, we're offering a free $5 Starbucks gift card to all attendees! Click here for more info:

Sage Fixed Assets helps manage the complexity of asset management as well as eliminate redundant data entry, increase accuracy, and reduce costs while guarding against regulatory noncompliance. This complete fixed asset management solution provides comprehensive depreciation calculations for financial and tax reporting, asset inventory tracking and reconciliation, and customized reporting, to arm front line employees with accurate information to effectively manage every step of the fixed asset lifecycle—from acquisition to disposal.

What is Sage Fixed Assets?

So, let's get into the nitty gritty. What exactly is Sage Fixed Assets? Sage Fixed Assets is a tool that allows you to track & manage your fixed assets through every step of the asset lifecycle. It automates, streamlines, and tracks the physical inventory and assets for a company and helps to depreciate fixed assets for federal and state compliance. By using this product companies can manage both complex and straight-line depreciation of their asset inventory

How do I use Sage Fixed Assets?

This fixed assets depreciation tool can be integrated with several Sage ERP business management solutions. Together they provide one solution that connects your financial and operational data to the processes of asset management from acquisition to disposal.

Sage Fixed Assets is perfectly suited for both large and small sized companies that have asset value in company inventory. Controllers, bookkeeper accountants, staff accountants, CFOs, vice presidents, directors, and even CEOs of smaller companies can benefit greatly from utilizing a fixed asset management solution. Additionally, ideal industries include: manufacturing, wholesale, retail, healthcare, education, distribution and several others.

Key Benefits to Tracking Your Fixed Assets

-

Streamline workflow, to gain greater visibility and manage fixed assets data with comprehensive depreciation calculations

- Being able to manage fixed assets data helps businesses understand the complete view of all of their assets in real-time. Without this data, customers will not be able to calculate the most profitable/valuable depreciation which can cause a loss in the amount of monetary benefits a company can maximize from tax deductions

- Being able to manage fixed assets data helps businesses understand the complete view of all of their assets in real-time. Without this data, customers will not be able to calculate the most profitable/valuable depreciation which can cause a loss in the amount of monetary benefits a company can maximize from tax deductions

-

Easily scan existing assets for detailed tracking of a location and the condition of all of your assets.

- Tracking helps companies manage and control physical inventory of assets. Inventory can be tracked across multiple locations and projects which is crucial in the accuracy of tracking the acquisition of new assets. By utilizing barcodes, as a tracking method, the process is automated and allows companies to track what assets they have, where each is located, what location it’s located in, when it was moved, and the cost and depreciation of each asset.

- Tracking helps companies manage and control physical inventory of assets. Inventory can be tracked across multiple locations and projects which is crucial in the accuracy of tracking the acquisition of new assets. By utilizing barcodes, as a tracking method, the process is automated and allows companies to track what assets they have, where each is located, what location it’s located in, when it was moved, and the cost and depreciation of each asset.

-

Get insight into areas like labor, locations, materials, and capital investment so you can get a pulse on all assets from acquisition to disposal

- Planning provides businesses the ability to manage and report on assets related to “in-progress” projects. Manage capital budgeting and assets usage and depreciation through project completion helps to manage accurate depreciation calculation before, during and after projects

- Planning provides businesses the ability to manage and report on assets related to “in-progress” projects. Manage capital budgeting and assets usage and depreciation through project completion helps to manage accurate depreciation calculation before, during and after projects

-

Benefit from pre-built reporting that allows you to accurately illustrate fixed assets data for audit history to complete asset management.

- The ability to create custom asset-based reports ensures specific and accurate data is readily available in your business. This can aid in compliance needs and also to alleviate audit pressures. It helps to eliminate time-consuming, manual consolidation for reporting and save time with the reduction of data entry errors.

"An effective fixed asset management solution reduces the immense job of inventory accounting and tracking to a management process; it overcomes the pitfalls of spreadsheets and provides a number of benefits."

Greg Cline, Research Analyst - Aberdeen, The Benefit of A Fixed Asset Management Solution

So what are you waiting for?

Save time, reduce errors, prevent overpayment of property taxes, and improve decision making with Sage Fixed Assets.

👇Click the button below to register for our upcoming coffee chat!