Amid the Coronavirus (COVID-19) global pandemic, governments worldwide are trying to figure out the best way to bolster the slowing economy including tax filing and payment extensions and even temporary rate reductions. Other nations, including the United States, are just beginning to respond.

Avalara has taken the time to compile tax news relating to the COVID-19 outbreak in this roundup so that business owners can focus on what really matters. They'll be updating the full article regularly as more information becomes available. We, however, have included the information relevant to the states we primarily service. If your state is not included please refer to the full article written by Avalara.

State Tax Relief

Arizona

State Income Tax Relief

Following the direction of Governor Doug Ducey, The Arizona Department of Revenue (ADOR) announced the extension of the filing and payment deadline for state income taxes from April 15 to July 15, 2020.

This new deadline also includes the exclusion of any late penalties that may have typically been assessed if filing or submitting payments had not been made by the previous filing deadline of April 15th and includes individuals, corporate, and fiduciary tax returns, however, it is encouraged that taxpayers should still file an extension should they anticipate needing more time beyond the newly appointed July 15th deadline.

California

Sales Tax Relief

An extended deadline of July 31, 2020 has been granted to small businesses filing for less than $1 million in tax on their Q1 returns. According to Avalara, "The same provisions apply to other tax and fee programs administered by the CTFA." Qualifying taxpayers don't need to file a request for extension or request relief from penalty or interest.

Taxpayers also have an additional 60 days to seek refund claims or an appeal of a California Department of Tax and Fee Administration tax determination. "This expands on the relief previously granted to small businesses, giving them an extra 90 days to file and pay any business taxes and fees administered by the CDTFA without incurring any penalties or interest," said Director Nick Maduros.

Filing and payment extensions or penalty and interest waivers may be available for other businesses, including Alcoholic Beverage, Cannabis, Cigarette & Tobacco Products, and more directly affected by COVID-19.

Colorado

Sales Tax Relief

Vail has suspended sales tax collections until further notice, however, Vail businesses will continue to collect sales tax from customers and file sales tax returns as usual as the current online filing and payment system allows taxpayers to file without paying.

Grand Junction is allowing businesses to request a temporary refund of sales and lodging taxes paid to the city in March. However, the request must be made by April 20, 2020 and must be paid back to the city by July 31, 2020. This temporary refund only applies to city sales, use, and lodging taxes paid.

State Income Tax Relief

An extension to file and pay state income taxes has been granted from April 15 to July 15, 2020, as well as an automatic six-month extension for all income tax returns that were due April 15, 2020, which now are due on or before October 15, 2020.

Frequent updates are being made on the Colorado Department of Revenue website.

Nevada

According to the Nevada State Department of Taxation all Taxation offices are closed to the public until further notice, however, in accordance with the U.S. Treasury Department, IRS, and the U.S. Department of Labor, several Coronavirus-related tax credits for small & mid-sized businesses will be available under the Families First Coronavirus Response Act (Act). Relief includes paid sick leave for workers affected by COVID-19, 100% employer reimbursement for paid leave pursuant to the Act, and more.

Texas

Sales Tax Relief

Businesses are urged to file and pay sales taxes on time but are being offered short-term payment agreements to those struggling to pay the full amount of sales taxes collected. In most instances, the Texas Comptroller will also provide waivers of penalties and interest.

Franchise Tax Relief

The filing and payment deadline for franchise tax is automatically extended to July 15, 2020.

Federal Tax Relief in the U.S.

While there are many states that are providing tax relief specific to their region, the Federal Government has also stepped in. On March 27, Congress passed a historic stimulus package, known as the CARES Act. The Coronavirus Aid, Relief, and Economic Security Act includes direct payments to taxpayers and expanded unemployment benefits.

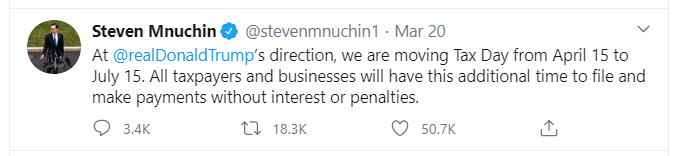

Additionally, the Treasury Department has moved Tax Day from April 15 to July 15, extending both the payment and the filing deadline. Treasury Secretary Steven Mnuchin tweeted, "All taxpayers and businesses will have this additional time to file and make payments without interest or penalties."

The Secretary of Treasury also encouraged businesses and individuals to file and pay their taxes on time if they can.

Deferments for 2019 taxes are also being allotted to individuals up to $1 million due and $10 million of the tax due for C-corporations. The relief applies also to the estimated tax payments for tax year 2020 that are due April 15, 2020.

The Families First Coronavirus Response Act is also a relief that was signed into law by President Trump and includes emergency assistance for food & nutrition, paid sick & leave benefits, unemployment, and more.

Read the full article for more information on tax relief efforts in Canada

As the world encounters the viral infection together, we are all in a state of unknown. It's important to note that there may be more changes to come and we will continue to update our content as necessary. Please refer to your state's taxation department for more accurate information.

If you or a loved one may have come in contact with COVID-19 please seek medical attention immediately. Remain healthy & safe💙