Sales Tax CPR Training

A manual sales tax process can affect the very well-being of your business. Not only is the process time and resource intensive, it leaves your business vulnerable to costly audits and fines. When you find yourself in a tax emergency (or if the process is just too cumbersome to sustain), don’t panic.

The webinar will offer six simple steps to perform CPR

— Calculation, Product taxability and Returns —

and you’ll be on your way to tax pain recovery and less risk.

REGISTER TODAY

Date: Tuesday, March 29

Time: 11:00 AM PT / 2:00 PM ET

Duration: One hour

Cost: Free!

On March 29th you’ll learn:

- The best way to determine where you have to collect, file and remit tax (nexus)

- How to manage product taxability issues

- Everything you need to know about tax exemptions

- The right way to file

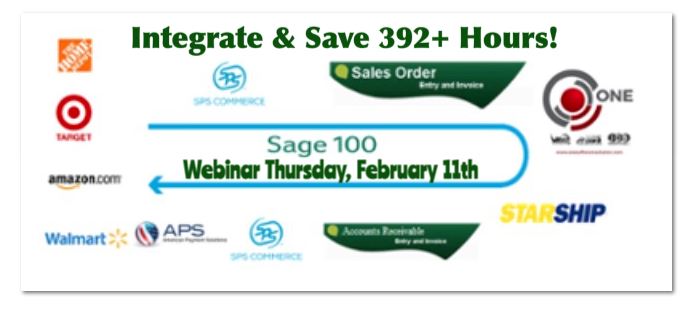

- The benefits of a sales tax automation solution

Register now to learn how sales tax automation

can help your business save both time and money.

REGISTER TODAY!