Sage 100 Cloud ERP- Electronic Reporting Module

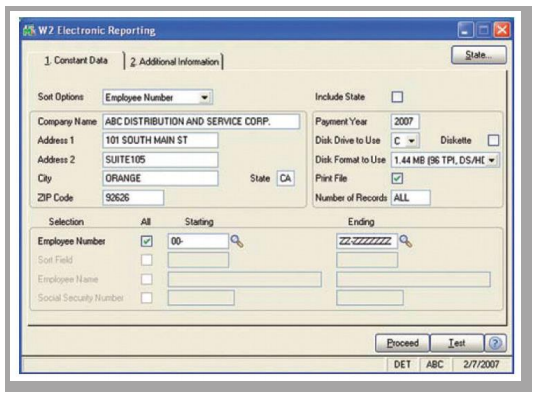

The Electronic Reporting module provides the capabilities for reporting wage and payment

information from the Payroll and Accounts Payable modules and 1099-INT, 1099-DIV, and

1099-MISC information and submit it electronically in the format required by the federal

government.

Several states have also adopted electronic reporting regulations, using the federal reporting

requirements as guidelines. Sage 100 Cloud ERP (formerly MAS 90 and MAS 200) users who file W-2s for employees or 1099s for vendors who work or live in the states that comply with either the current federal MMREF-1 format or the TIB-4 format can file their state information using the Electronic Reporting module.

This module connects with the Payroll and Accounts Payable modules, to help you comply with tax regulations quickly and easily.

B E N E F I T S

- Generate accurate, fully compliant federal and state reports and minimize rejections

- Eliminate tedious manual entry with information automatically flowing through from the Payroll module

- Automatically retrieve 1099-INT, 1099-DIV, and 1099-MISC information from the Accounts Payable module

- Create state-specific electronic media files using MMREF-1 or TIB-4 formats

- Easily comply with test file requirements

We would love to speak with you about how Sage 100 Cloud ERP,

partnered with Klear Systems, Inc., can benefit your organization.

Give us a call at (949) 681-8135,

email us at info@klearsystems.com

or complete the form to the right and we’ll reach out to you!